High-frequency trading (HFT) represents one of the most technologically advanced and mathematically sophisticated segments of modern financial markets. Operating on millisecond or microsecond timescales, HFT firms execute large numbers of trades exploiting tiny price inefficiencies.

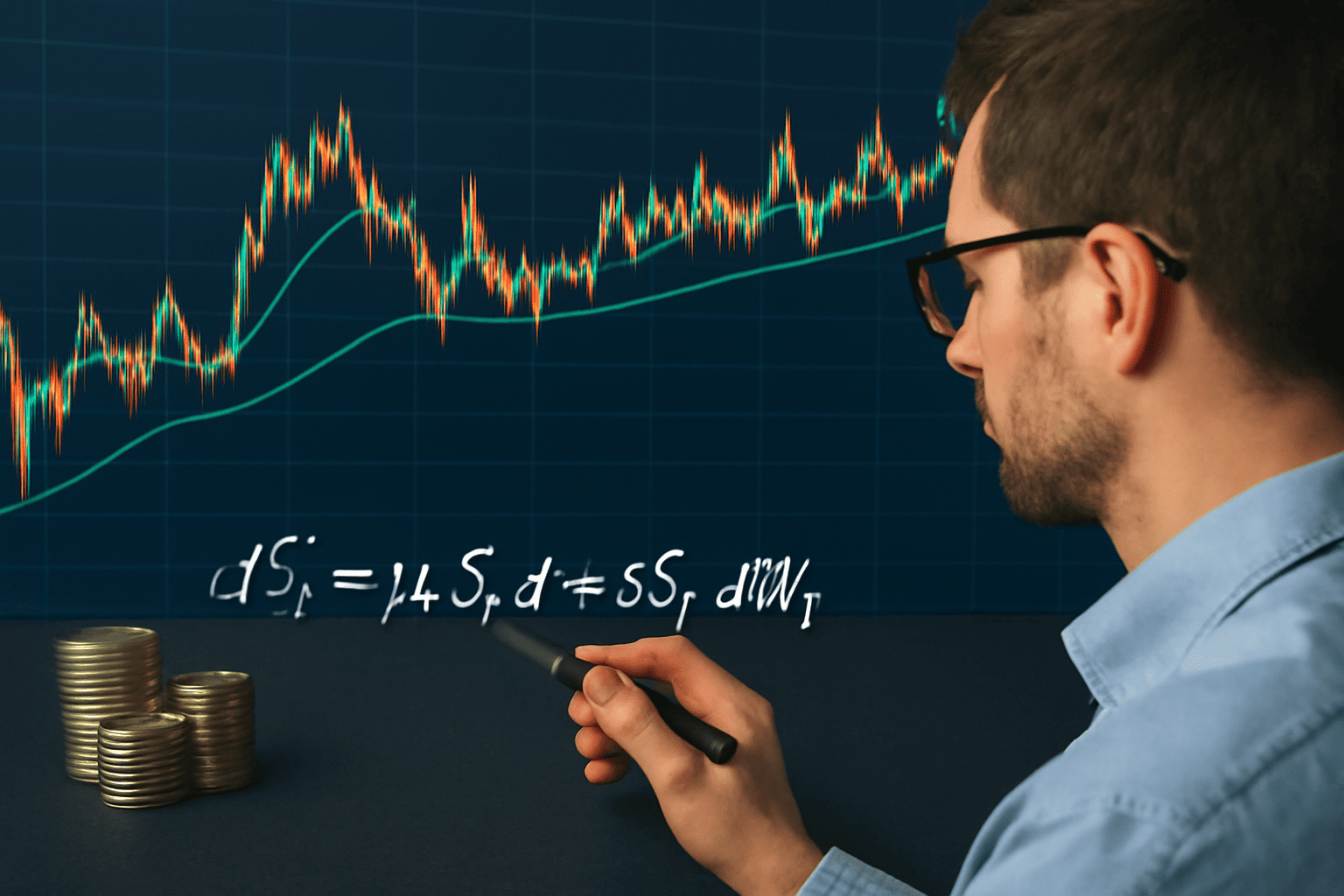

Modeling such rapid market dynamics demands robust mathematical frameworks that capture the stochastic nature of order flow, price changes, and market impact. Stochastic models play a pivotal role in describing, predicting, and optimizing HFT strategies.

This article explores the mathematical foundations of stochastic modeling in HFT, covering key models, applications, challenges, and innovations.

Table of Contents

-

Overview of High-Frequency Trading

-

Why Stochastic Models Matter in HFT

-

Fundamental Stochastic Processes in HFT

-

Modeling Order Flow with Point Processes

-

Price Dynamics and Microstructure Noise

-

Hawkes Processes and Self-Exciting Models

-

Stochastic Control in Optimal Execution

-

Queueing Theory and Limit Order Books

-

Market Impact Models and Price Manipulation

-

Statistical Arbitrage and Mean Reversion Models

-

Machine Learning and Stochastic Modeling in HFT

-

Risk Management in High-Frequency Trading

-

Challenges and Limitations

-

Future Directions in Stochastic HFT Models

-

Conclusion

Overview of High-Frequency Trading

HFT involves automated trading strategies that submit, modify, and cancel orders at extremely high speeds. Success depends on minimizing latency, exploiting short-lived arbitrage opportunities, and managing risk in volatile microseconds.

Why Stochastic Models Matter in HFT

Market data at high frequencies is noisy, discrete, and irregularly spaced. Deterministic models fail to capture this randomness. Stochastic models enable:

-

Capturing the randomness and clustering of trades

-

Modeling complex event dependencies

-

Designing adaptive algorithms for execution and risk

-

Quantifying uncertainty and market impact

Fundamental Stochastic Processes in HFT

-

Poisson Processes: Model random arrival of orders or trades.

-

Brownian Motion: Models price diffusion.

-

Jump Processes: Account for sudden price changes.

-

Markov Chains: Describe state transitions in order books.

Modeling Order Flow with Point Processes

Order arrivals can be modeled as point processes, random sequences of discrete events over time. The Poisson process assumes independence and constant rate, but real order flow often exhibits clustering.

Hawkes Processes and Self-Exciting Models

The Hawkes process is a self-exciting point process where each event increases the likelihood of future events in short order. This captures trade clustering and market activity bursts, essential for modeling liquidity and volatility.

Price Dynamics and Microstructure Noise

Prices at high frequencies contain microstructure noise—small random fluctuations caused by the discrete nature of trading and bid-ask bounce. Stochastic models help separate true price signals from noise.

Stochastic Control in Optimal Execution

Traders seek to minimize costs and risks when executing large orders. Stochastic control models frame optimal execution as minimizing expected cost given stochastic price dynamics and order flow.

Queueing Theory and Limit Order Books

The limit order book (LOB) represents the standing buy and sell orders. Queueing models describe the dynamics of order arrivals, cancellations, and executions, essential for understanding liquidity and price impact.

Market Impact Models and Price Manipulation

Stochastic models quantify how trades impact prices, distinguishing between temporary and permanent effects. These insights guide trade scheduling to minimize adverse impact.

Statistical Arbitrage and Mean Reversion Models

HFT exploits short-term mean-reverting patterns in prices or spreads. Models based on Ornstein-Uhlenbeck processes describe such behavior, enabling profitable statistical arbitrage strategies.

Machine Learning and Stochastic Modeling in HFT

Combining machine learning with stochastic models enhances:

-

Pattern recognition in noisy data

-

Adaptive parameter estimation

-

Real-time decision making

Risk Management in High-Frequency Trading

Stochastic models underpin:

-

Real-time risk monitoring

-

Detection of anomalous patterns

-

Control of exposure to price jumps and liquidity shocks

Challenges and Limitations

-

Model misspecification due to complex market dynamics

-

High computational requirements for real-time use

-

Data quality and latency constraints

Future Directions in Stochastic HFT Models

-

Integration of rough volatility models for better noise capture

-

Use of reinforcement learning with stochastic environments

-

Quantum computing applications for faster simulations

Stochastic models form the mathematical core of high-frequency trading, enabling precise description and control of rapidly evolving market phenomena. As technology advances, integrating these models with AI and novel computational techniques will further transform HFT strategies and risk management.